SmartLoan

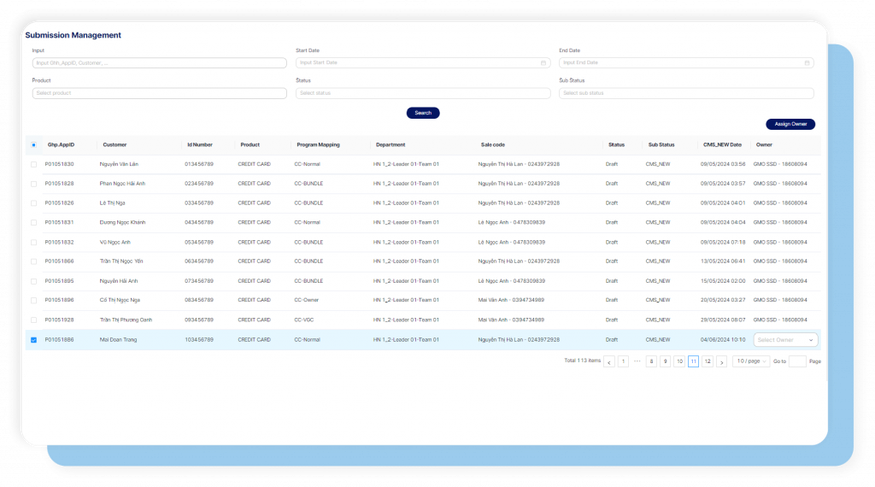

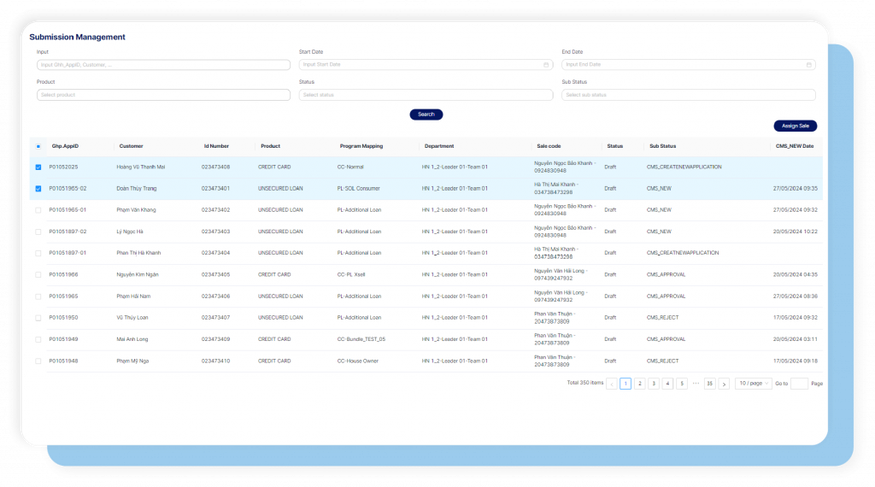

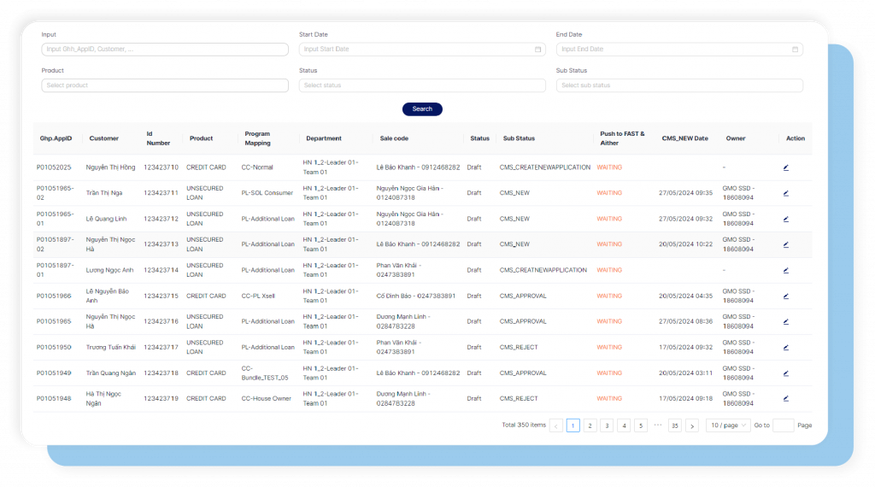

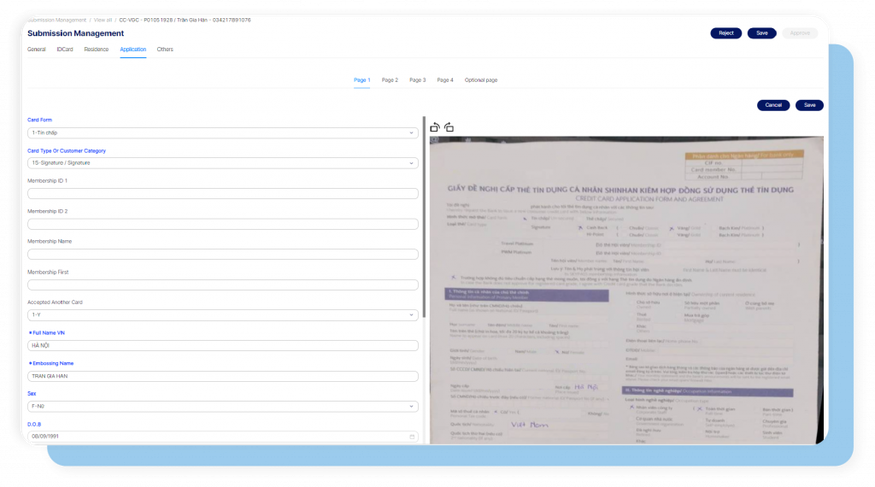

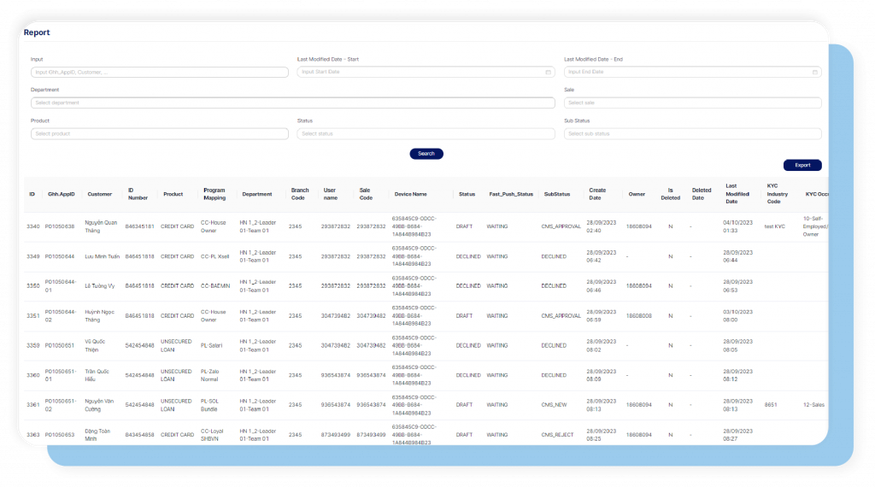

Automate the loan process, simplify the collection and processing of customer records. Thanks to the application of OCR technology, SmartLoan shortens the processing time from 3-5 days to 3-5 hours, ensuring accuracy of up to 99%, significantly improving the customer experience.

Business Challenges

Features (USP)

Client Success Stories

Discover how our customer successfully digitize their businesses with GMO-Z.com RUNSYSTEM

Featured Projects

SmartLoan is deployed in the form of On-Premise. The system provides higher control and security for businesses, especially for the Finance - Banking industry with high requirements.

SmartLoan is especially suitable for the Finance and Banking sector thanks to its ability to meet professional business operations, ensure high security and support flexible customization according to the specific requirements of each business.

Smart Loan has the ability to synchronize and connect data with specific systems of Finance - Banking companies such as: Core Banking, LOS, DMS, anti-credit scoring system...

Please leave your information in the form to receive detailed advice and quotes from our experts.